PerkStreet Financial Review

November 26, 2010

What is PerkStreet Financial?

PerkStreet is a relative newcomer to the online banking industry. What makes PerkStreet different from those other online banks you’re already familiar with like ING Direct and HSBC?

- PerkStreet only offers a checking account that utilizes a debit card and paper checks.

- PerkStreet does not currently offer any other banking products like savings accounts, certificates of deposit, credit cards, or mortgages.

- PerkStreet’s debit card has an intriguing cash back rewards system.

As an online bank, Perkstreet doesn’t have branches to drive up operating costs so they can afford to offer their cash back checking account.

Online Banking

As with other online banks, you can access your Perkstreet accounts from your computer or your mobile device. Being online does give them the challenge of accepting deposits but they’ve come up with four ways to let you build your account balance. The simplest two are direct deposits and transfers from another bank. You can also send it in using pre-paid postage envelopes or use free overnight check mailing through services like the UPS Store.

Getting your money out is pretty simple. You can use your PerkStreet debit card for purchases or to withdraw cash in their network of over 37,000 ATMs. In terms of safety, your funds at PerkStreet are covered by FDIC up to $250,000.

Perkstreet Debit Card Cash Back

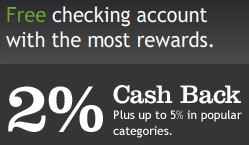

PerkStreet’s debit card offers you cash back on every single purchase you make with the card. That in and of itself should get your attention.

How does it work? It’s all based on your account balance at the start of the day.

If your account balance is $5,000 or more at the start of the day you will earn 2% cash back on every purchase you make that day using the non-PIN method (meaning you sign for the purchase). You also earn 2% for the first three months of having the account regardless of your account balance.

If your account balance is under $5,000 all is not lost. You still earn 1% cash back on every non-PIN debit card purchase.

Cash back is awarded on a variety of options such as Visa gift cards that can be spent anywhere, or for retailers like Target, Best Buy, and Amazon.

PerkStreet Coffee and Music Rewards

You don’t have to get your rewards in cash. PerkStreet also offers the ability to get your rewards in music downloads and cups of coffee. The rewards work out the same except for one catch.

Coffee Rewards

With the coffee rewards you’ll earn 2 cups of coffee worth $2 for every $200 in eligible debit card spending. (You can redeem the rewards at Starbucks, Dunkin Donuts, and others.) That’s $4 on $200 in spending. That’s 2%.

However those rewards get boosted to 5 cups of coffee from every $200 of spend (worth $10, equivalent to 5% cash back) when you spend at select retailers that partner with PerkStreet.

Music Rewards

The music rewards are similar to the coffee rewards. You get 2 songs worth $1 for every $100 in spend. That’s a 2% reward. You can boost that reward to 5 songs per $100 in eligible debit card spending by shopping at specific retailers.

Is Perkstreet Right for You?

Since PerkStreet is a checking account, you’re not earning 1% or 2% on your entire balance in your account. You’ll only earn cash back on what you spend. If you only spend $500 per month and kept your account balance above $5,000 the entire time you would earn 2% or $10 in rewards. If your account balance slipped and you earn 1% rewards on that $500 you’d get $5 in rewards.

Alternatively if you kept $5,000 in a savings account with with a different online bank you would earn 1.1%, or about $4.58 in interest, every month. Without having to spend any money or worry about keeping your account balance above $5,000.

At the end of the day the true benefit you’ll get from opening a PerkStreet account will be determined by:

- how much money you keep in your checking and saving accounts

- how much money you spend every month (specifically on debit cards, not automatic bill pay)

Opening a PerkStreet account is a pretty simple process so one way to see if it fits your needs is to try it out and see what kind of rewards you earn. PerkStreet periodically offers a bonus for opening a new account so you might even get some extra cash for trying them out. To earn rewards with Perkstreet, get more information here.

All posts by Kevin

Comments

5 Responses to PerkStreet Financial Review

Trackbacks/Pingbacks